WoodmenLife Extras Because We’re More Than Life Insurance®

When you purchase life insurance from WoodmenLife, you become part of our family1, joining other people who share your commitment to family, community and country. Through WoodmenLife, you have opportunities to connect with others, give back locally and honor those who make an impact.

scholarships

Help Paying for College

Apply for the WoodmenLife Focus Forward Scholarship®. We’ve awarded $3M to students since 2017.

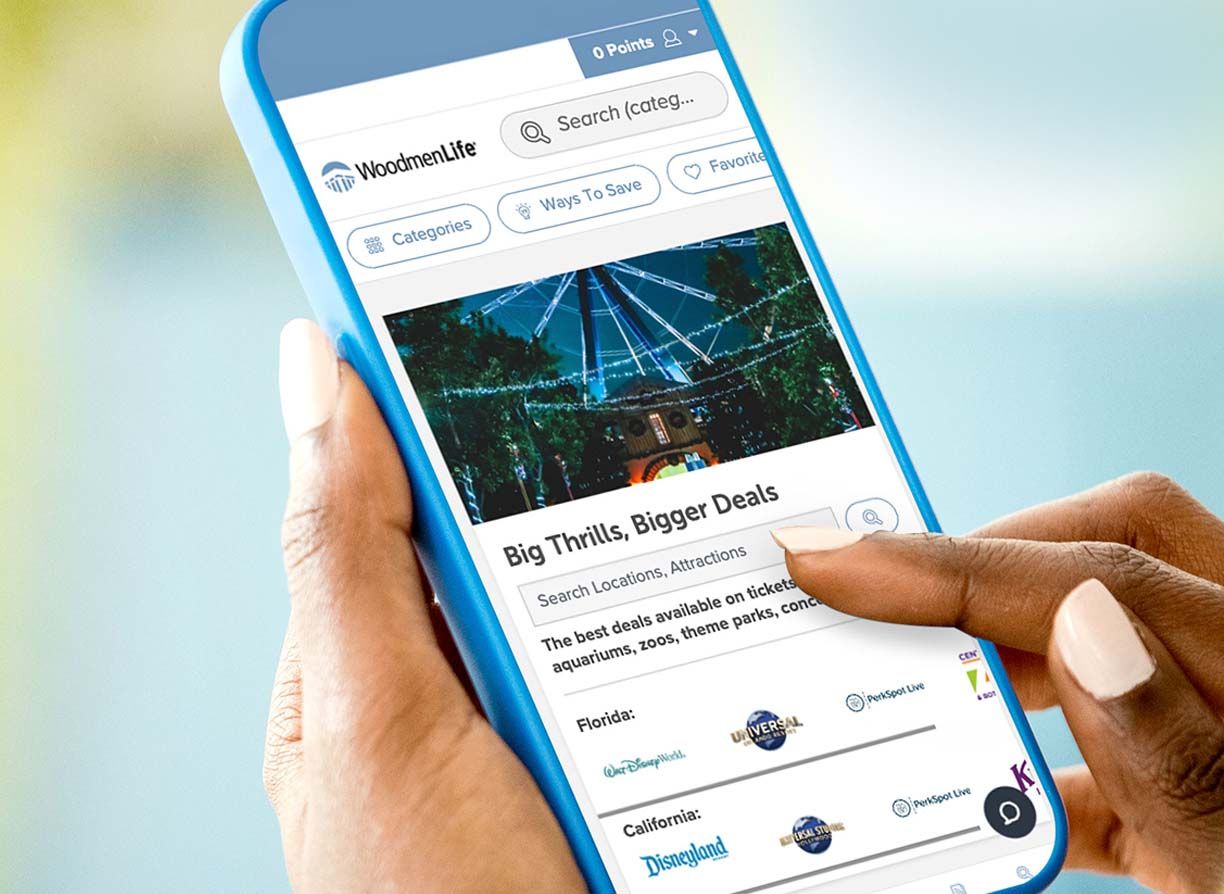

Discounts

Everyday Shopping Discounts

Our discount program – Life’s Perks – gives you access to more than 30,000 discounts at retailers nationwide.

National Community Focus

Fighting Hunger

We have been fighting hunger across the country since 2015 through our National Community Focus.

Get More Out Of Life Now Explore Our Extras

When you become part of the WoodmenLife family, you have access to a wide range of valuable extras2. There’s no extra cost nor obligation to use them. It’s just one way our family is committed to helping yours at every stage in life.

Our community activities offer fun and unique opportunities for your family and guests to come together to socialize, while having a great time experiencing local attractions.

Our discount program – Life’s Perks – gives you access to more than 30,000 discounts on everyday items at local and national retailers, such as Verizon, Sam’s Club and more. Plus, redeem local coupons and online deals on the go via the PerkSpot Mobile App3.

We can’t stop natural disasters, but we can help our members who experience one by providing financial assistance of up to $1,000.

Protecting your child when you can’t is important. That’s where we step in by offering $1,000 monthly for the care of members’ children if they are orphaned.

Since 2017, we have awarded scholarships worth $2.7 million to high school graduates for continuing educational opportunities through the WoodmenLife Focus Forward Scholarship®.

With LawAssure™, WoodmenLife members can create customized wills, powers of attorney and healthcare directives with free, easy-to-use online templates3.

Protecting the Financial Future of Families Since 1890

Join the

WoodmenLife

Family

You become a member of the WoodmenLife family and gain access to our extras when you purchase a WoodmenLife product. Click the button below to get started and a Representative will be in touch with you soon.

Connect with WoodmenLife

Find a Local

All input fields are required unless marked as optional.

1. An individual becomes a member by joining our shared commitment to family, community and country, and by purchasing a WoodmenLife product.

2. WoodmenLife Extras are available to members. An individual becomes a member by joining our shared commitment to family, community and country, and by purchasing a product. These extras are not contractual, are subject to change and have specific eligibility requirements, such as length of membership, number of qualifying members in household and/or qualifying event.

3. WoodmenLife has entered into sponsored marketing relationships with companies that agree to offer discounts to WoodmenLife members. WoodmenLife is not affiliated with these companies and does not administer these discounts for products or services.

4. WoodmenLife has entered into a sponsored marketing relationship with Epoq, Inc. (Epoq) to offer document preparation services to WoodmenLife members. Epoq is an independent service provider. WoodmenLife is not affiliated with Epoq and does not administer these document preparation services. WoodmenLife does not provide, is not responsible for, does not assume liability for, and does not guarantee the accuracy, adequacy or results of any service or documents provided by Epoq. WoodmenLife, its employees and representatives are not authorized to give legal advice. Not all services are available in all states.

5. $25,000 benefit applies to officially registered non-military First Responders. WoodmenLife Extras are not contractual, are subject to change and have specific eligibility requirements.

Web 300 R-5/25