Final Expense Whole Life Insurance

Your Commitment to Your Family Lives On

A final expense life insurance policy can offer your family peace of mind in their time of grief.

What is Final Expense Life Insurance?

Final expense life insurance is a type of whole life insurance that helps cover end-of-life costs, such as funeral and burial costs or other final expenses.

With WoodmenLife, you have two Final Expense life insurance options:

WoodmenLife Level Death Benefit FE: It pays the full death benefit.

WoodmenLife Graded Death Benefit FE: The death benefit after the first two policy years is based on the face amount at the time of policy issue, regardless of the insured’s cause of death. Death benefit is not guaranteed during contestability and suicide exclusion periods.7

What Makes WoodmenLife Final Expense Life Insurance Different?

We've designed our final expense life insurance to be simple, quick, and easy. That way, you can plan ahead with confidence.

Fast Application

Apply in as litle as 10 minutes.

Stress-Free Process

Just answer a series of questions. No invasive medical exams required — no needles or swabs.

Meaningful Coverage

Depending on the type of plan, up to $50,0008 is available, starting after your first payment is received.

Accelerated Death Benefit Rider

Access a portion of your benefit while living if you’re diagnosed with a qualifying terminal illness3.

Extras for You

When you become a member of WoodmenLife, you have access to a wide range of valuable extras.9 From free self-service legal documentation to customized online financial learning experiences, these extras are designed to help your family right now.

LawAssure™

Easy-to-Use Online Legal Templates

Advance planning can make change easier to cope with, even difficult change like illness or death.

Financial Education

Build Confidence in Your Financial Decisions

Increase your financial knowledge with resources on budgeting, saving, retirement, planning, and more.

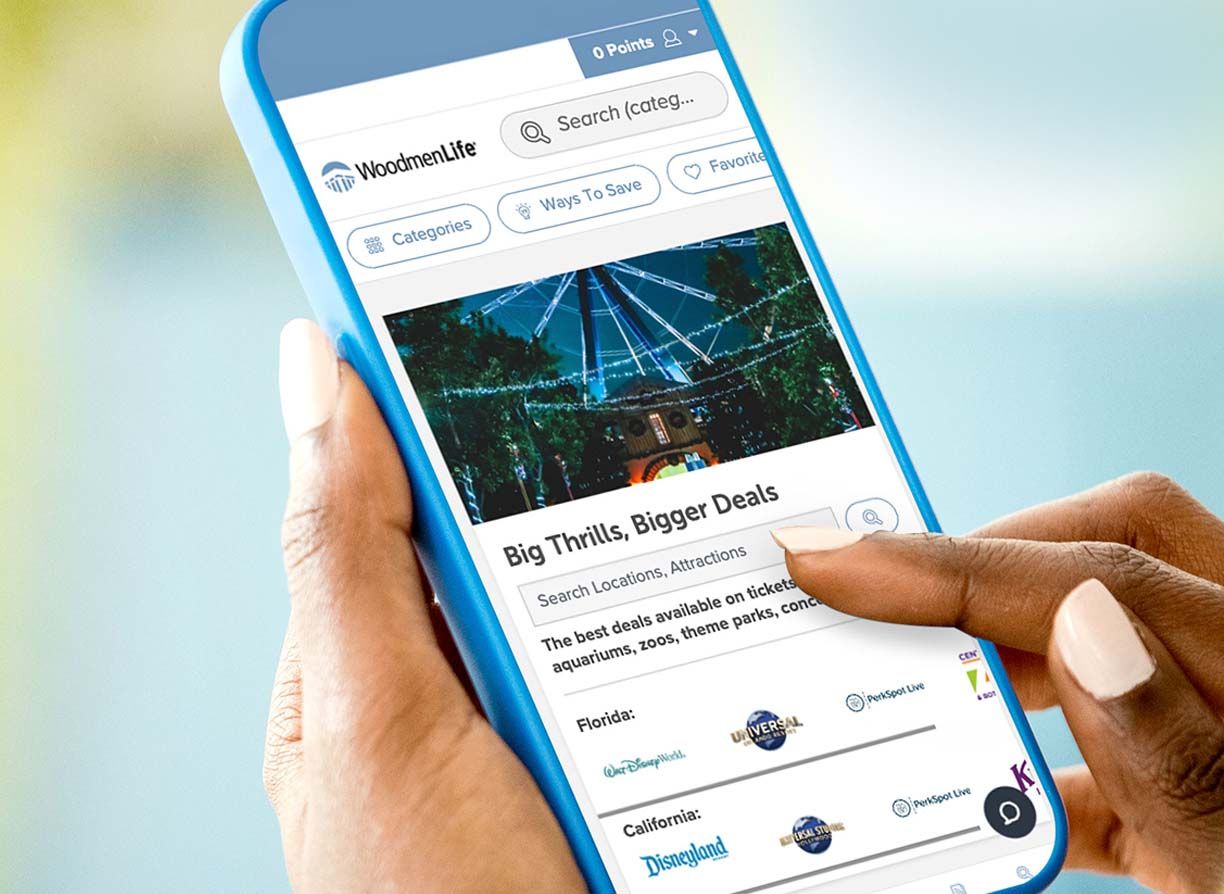

Discounts

Everyday Shopping Discounts

Our discount program – Life’s Perks® – gives you access to more than 30,000 discounts at retailers nationwide.

Final Expense Calculator

Determine the Right Final Expense Coverage for You

Compare Coverage

Final Expense Life Insurance vs. Traditional Whole Life Insurance

While both final expense and traditional whole life insurance are types of permanent life insurance that offer benefits after a policyholder’s death, there are several key differences.

Final Expense Whole Life | Traditional Whole Life |

|---|---|

| Coverage | Coverage |

Permanent | Permanent |

Helps cover end-of-life expenses, such as funeral, cremation, and burial costs1 | Often used for broader financial planning, income replacement, and leaving a legacy |

| Benefit Amount | Benefit Amount |

Typically smaller death benefit; often less than $50,000 | Typically larger death benefit; sometimes into the millions |

Premiums are generally lower | Premiums are generally higher |

| Underwriting | Underwriting |

No invasive medical exams required2 — no needles or swabs | Often requires a medical examination |

Policy can be issued quickly | Policy may take longer to issue |

| Included Riders | Included Riders |

Accelerated Death Benefit Rider3 | Accelerated Death Benefit Rider4 or |

Chronic and Terminal Illness | |

Accelerated Death Benefit Rider5 | |

| Optional Riders6 | Optional Riders6 |

Accidental Death Benefit Rider | Accidental Death Benefit Rider |

Disability Waiver of Premium Rider | |

Applicant Waiver of Premium Rider | |

Guaranteed Insurability Rider | |

| Issue Ages | Issue Ages |

50-85 (Varies by type of insurance) | 0-85 (Varies by type of insurance) |

WoodmenLife’s final expense life insurance is accessible, easy to apply for, and can be a relief to your family. By having life insurance to pay for your funeral and burial or cremation, they’ll know you thought of everything.

Why WoodmenLife

Discover The Value We Bring

Build a Plan That's Right for You

Find A Local Representative

Make smart choices for your future. We can help you find the best way to reach your goals.

Web 277 R-12/25